Violation Bank Secrecy Act Regulations

The idea of cash laundering is very important to be understood for those working in the financial sector. It is a process by which soiled money is converted into clean money. The sources of the money in precise are prison and the money is invested in a means that makes it appear like clean money and hide the identification of the prison part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the new clients or sustaining existing customers the duty of adopting satisfactory measures lie on every one who is part of the group. The identification of such ingredient to start with is straightforward to take care of as a substitute realizing and encountering such situations in a while in the transaction stage. The central bank in any country gives full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such conditions.

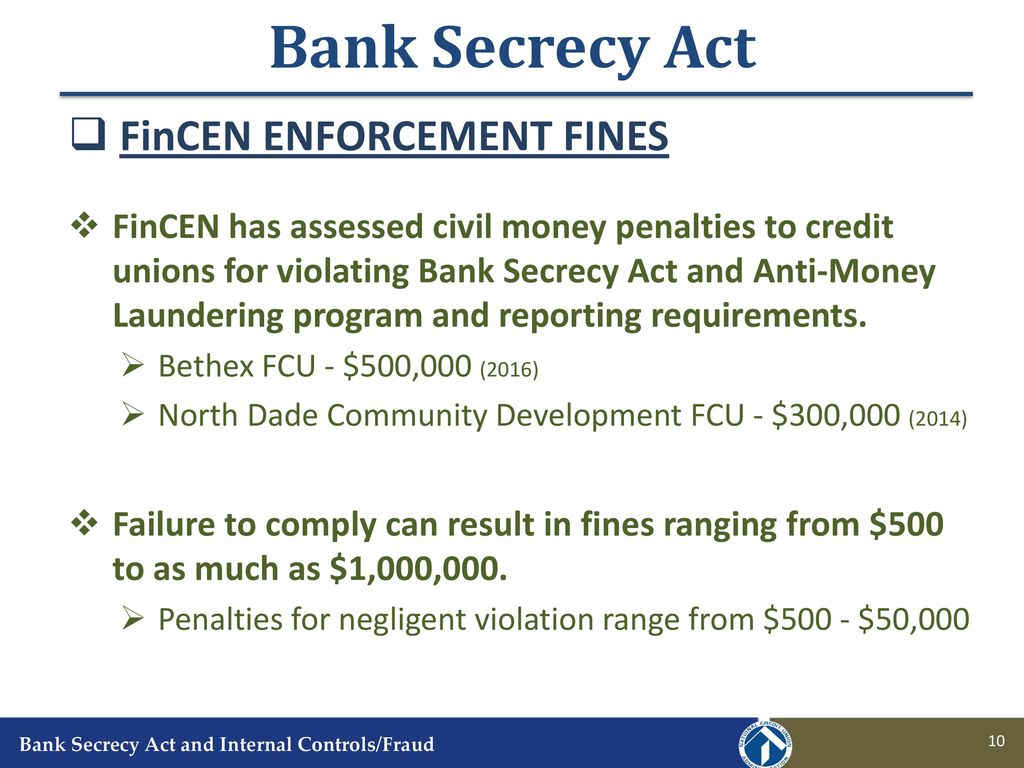

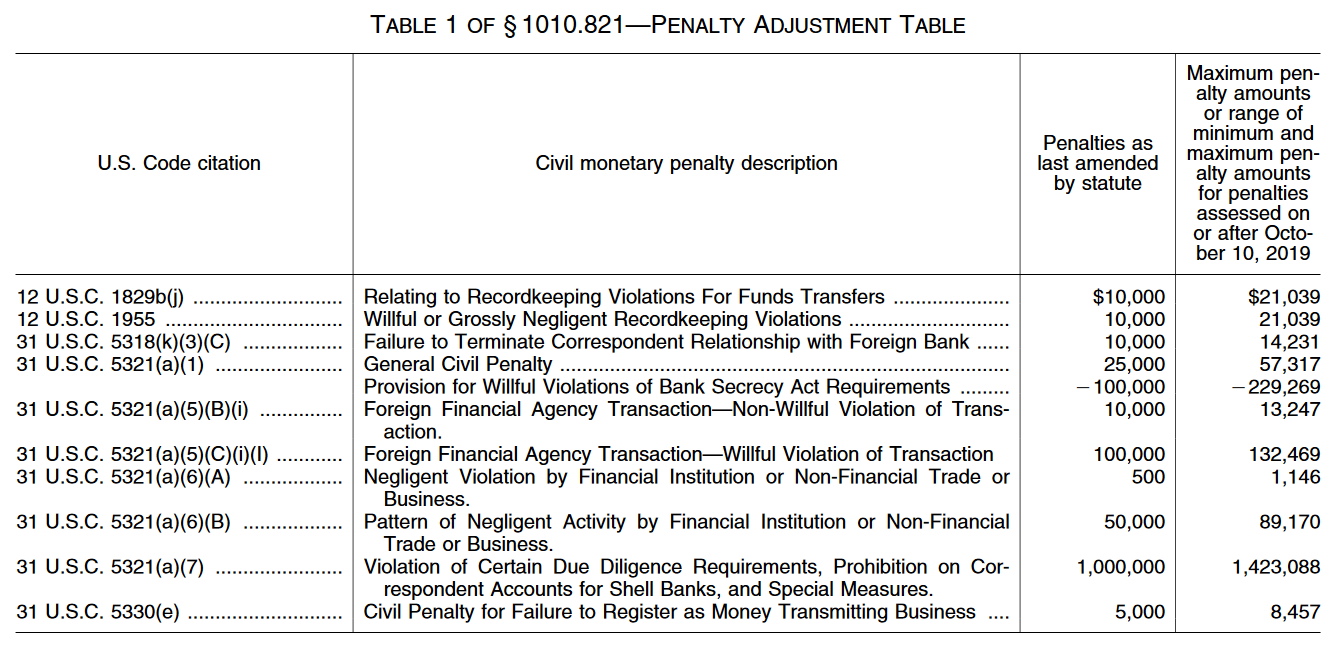

A negligent violation which is generally a violation due to the banks carelessness starts at 500 and can be as high as 1146 for each violation. Prior to the Rule FinCEN had not increased its civil money.

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

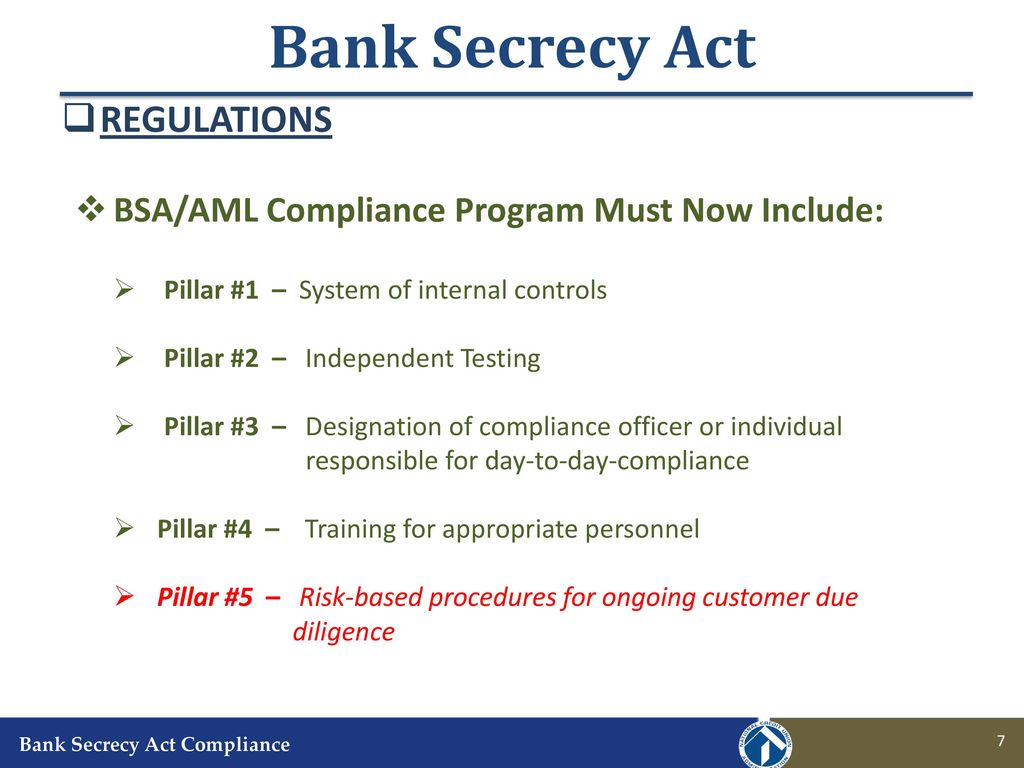

Title 31 revisions include new BSA violations and penalties regarding incomplete or false reports and transactions that involve entities labeled as primary money laundering concerns.

Violation bank secrecy act regulations. Section 5311 et seq requires financial institutions to maintain appropriate records and to file certain reports that are used in criminal tax or regulatory investigations or proceedings. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. The penalty amount could not exceed 500.

Joint Statement on Enforcement of Bank Secrecy ActAnti-Money Laundering Requirements. 10 First as an institution subject to supervision. Federal banking regulators clarify BSAAML compliance violation response.

The Board of Governors of the Federal Reserve System Federal Reserve the Federal Deposit Insurance Corporation FDIC the National Credit Union Administration NCUA and the Office of the Comptroller of the Currency OCC. A federal law the Bank Secrecy Act BSA mandates that financial institutions must collect and retain information about their customers and their identities and share that information with the Financial Crimes Enforcement Network FinCEN a bureau within the Department of Treasury. Bank Secrecy Act Including Failures in AML and SAR Filing Programs.

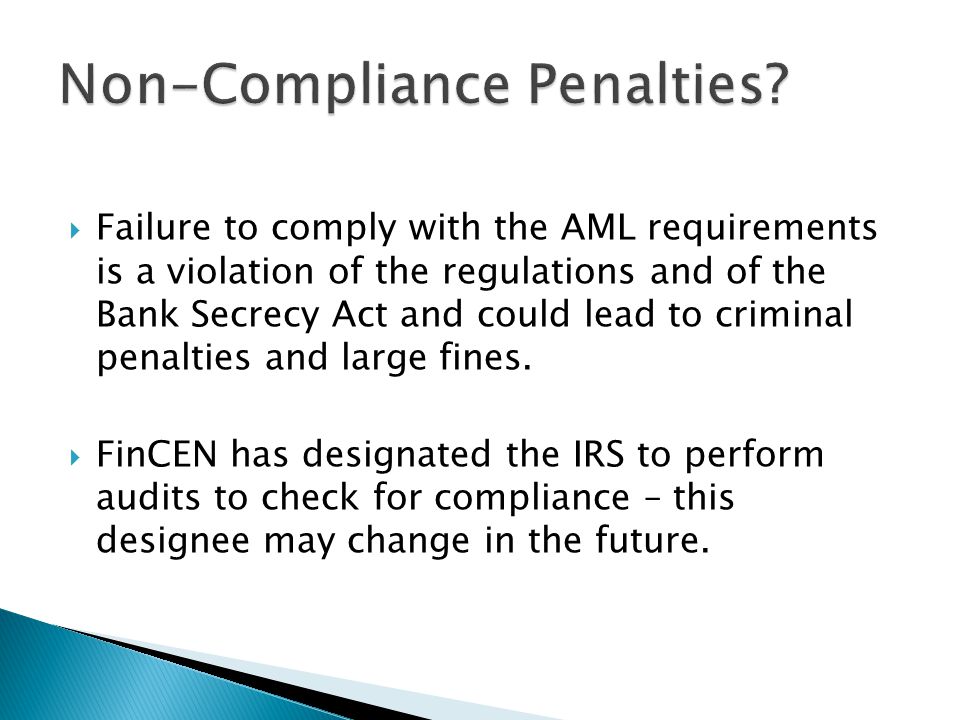

Violations of certain BSA provisions or special measures can make an institution subject to a criminal money penalty up to the greater of 1million or twice the value of the transaction. Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty. 31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA.

The Financial Crimes Enforcement Network FinCEN the bureau of the US Department of the Treasury responsible for oversight and enforcement of the Bank Secrecy Act BSA has issued an interim final rule Rule that significantly increases the statutory penalties for various violations of the BSA and its applicable regulations. If the individual commits a willful BSA violation while breaking another law or committing other criminal activity he or she is subject to a fine of up to 500000 or ten years in prison or both. Kris Doswell senior vice president of marketing and training at First National Bank in Hutchinson said the Bank Secrecy Act is one of many federal regulations that.

Whenever the national bank detects any known or suspected Federal criminal violation or pattern of criminal violations committed or attempted against the bank or involving a transaction or transactions conducted through the bank and involving or aggregating 25000 or more in funds or other assets where the bank believes that it was either an actual or potential victim of a criminal violation or series of. Include as much information about the violation as possible. In the context of a civil enforcement action the term willful has been held to mean acting with a reckless disregard for obligations under law or regulation.

Helping stop those who violate the CEA by failing to comply with the Bank Secrecy Act BSA or related regulations. Financial institutions are required to provide all requested information on the CTR including the following for the person conducting the transaction. A pattern of carelessness can cost up to 89000 willful violations can be up to 21000 and general civil penalties can be 57000 for each violation.

Congress enacted the BSA to prevent. What is the fine for violating Bank Secrecy Act regulations. Each money services business should identify and assess the money laundering risks that may be associated with its unique products services customers and geographic locations.

BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 Transactions regulations must be filed with the IRS. Two strikes and youre out say four federal agencies to repeat violators of Bank Secrecy Actanti-money laundering BSAAML compliance requirements. The review should determine whether the business is operating in compliance with the requirements of the Bank Secrecy Act and the business own policies and procedures.

The Bank Secrecy Act and the regulations issued pursuant to that Act were willful. The Bank Secrecy Act of 1970 Public Law 91-508 codified to 31 USC. The four agenciesthe Federal Reserve System the Federal Deposit Insurance Corporation FDIC the National Credit Union.

BSA-Related Violations For state-chartered nonmember bankssupervised by the FDIC applicable BSA-related violations include infractions ofFDIC Rules and Regulations 12 CFR3268 and 12 CFR 353 as well as theDepartment of Treasury Regulations 31 CFR 103. These regulations inaddition to other applicable legal require-ments are summarized as. Regulatory supervision of reporting companies is expected to intensify with the Anti-Money Laundering Act of 2020 AMLA amendment of Title 31 of the Bank Secrecy Act BSA.

Like that in the. The penalty amount could not exceed 500.

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Bank Secrecy Act Internal Controls Fraud Ppt Download

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download

Bsa Aml Violations Can Cost You Nafcu

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers

Bank Secrecy Act Internal Controls Fraud Ppt Download

Bank Secrecy Act Compliance Ppt Download

Bank Secrecy Act Bsa Bsaamlcipofac For Operations Http

Bank Secrecy Act Bsa Bsaamlcipofac For Operations Http

Https Www Fdic Gov Regulations Examinations Supervisory Insights Siwin06 Siwinter06 Article3 Pdf

Bsa Violation Civil Penalties Increase Nafcu

The world of regulations can appear to be a bowl of alphabet soup at occasions. US cash laundering rules are no exception. Now we have compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Threat is consulting agency targeted on defending financial providers by decreasing danger, fraud and losses. We have now massive financial institution experience in operational and regulatory danger. We have a strong background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus money laundering brings many adverse penalties to the organization due to the risks it presents. It will increase the likelihood of main dangers and the opportunity value of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment